Page 11 - ChipScale_Nov-Dec_2020-digital

P. 11

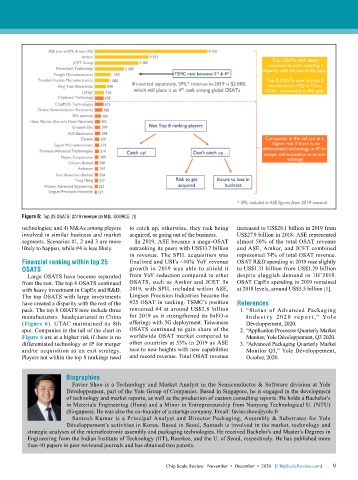

Figure 6: Top 25 OSATS: 2019 revenue (in M$). SOURCE: [1]

technologies; and 4) M&As among players to catch up, otherwise, they risk being increased to US$28.1 billion in 2019 from

involved in similar business and market acquired, or going out of the business. US$27.9 billion in 2018. ASE represented

segments. Scenarios #1, 2 and 3 are more In 2019, ASE became a mega-OSAT almost 50% of the total OSAT revenue

likely to happen, while #4 is less likely. outranking its peers with US$13.7 billion and ASE, Amkor, and JCET combined

in revenue. The SPIL acquisition was represented 74% of total OSAT revenue.

Financial ranking within top 25 finalized and USI’s ~10% YoY revenue OSAT R&D spending in 2019 rose slightly

OSATS growth in 2019 was able to shield it to US$1.31 billion from US$1.29 billion

Large OSATS have become separated from YoY reduction compared to other despite sluggish demand in 1H’2019.

from the rest. The top 8 OSATS continued OSATS, such as Amkor and JCET. In OSAT CapEx spending in 2019 remained

with heavy investment in CapEx and R&D. 2019, with SPIL included within ASE, at 2018 levels, around US$5.5 billion [1].

The top OSATS with large investments Lingsen Precision Industries became the

have created a disparity with the rest of the #25 OSAT in ranking. TSMC’s position References

pack. The top 8 OSATS now include three remained #4 at around US$2.8 billion 1. “Status of Advanced Packaging

manufacturers headquartered in China for 2019 as it strengthened its InFO-x I n d u s t r y 20 20 r e p o r t ,” Yole

(Figure 6). UTAC maintained its 8th offerings with 5G deployment. Taiwanese Développement, 2020.

spot. Companies in the tail of the chart in OSATS continued to gain share of the 2. “Application Processor Quarterly Market

Figure 6 are at a higher risk if there is no worldwide OSAT market compared to Monitor, Yole Développement, Q3 2020.

differentiated technology or IP for merger other countries at 55% in 2019 as ASE 3. “Advanced Packaging Quarterly Market

and/or acquisition as an exit strategy. rose to new heights with new capabilities Monitor Q3,” Yole Développement,

Players not within the top 8 rankings need and record revenue. Total OSAT revenue October, 2020.

Biographies

Favier Shoo is a Technology and Market Analyst in the Semiconductor & Software division at Yole

Développement, part of the Yole Group of Companies. Based in Singapore, he is engaged in the development

of technology and market reports, as well as the production of custom consulting reports. He holds a Bachelor’s

in Materials Engineering (Hons) and a Minor in Entrepreneurship from Nanyang Technological U. (NTU)

(Singapore). He was also the co-founder of a startup company. Email: favier.shoo@yole.fr

Santosh Kumar is a Principal Analyst and Director Packaging, Assembly & Substrates for Yole

Développement’s activities in Korea. Based in Seoul, Santosh is involved in the market, technology and

strategic analyses of the microelectronic assembly and packaging technologies. He received Bachelor’s and Master’s Degrees in

Engineering from the Indian Institute of Technology (IIT), Roorkee, and the U. of Seoul, respectively. He has published more

than 40 papers in peer reviewed journals and has obtained two patents.

Chip Scale Review November • December • 2020 [ChipScaleReview.com] 9 9