Page 9 - Chip Scale Review_November December_2022-digital

P. 9

25 EU countries, but also Israel, Turkey

and Norway. The second pillar is to set

up more “Open EU Foundries” using

advanced technology nodes. The third

pillar is to ensure continuity of supply to

the continent and the ability to intervene

in case of a supply-related crisis.

Similar to the EU’s efforts, Japan’s

Minist r y of Economy, Trade and

Industry (METI) has taken significant

steps to boost domestic production of

advanced chips. In the late eighties,

Japan manufact ured over 50% of

the world’s semiconductors. Today,

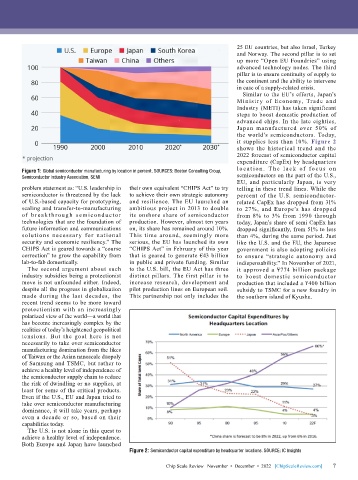

it supplies less than 10%. Figure 2

shows the historical trend and the

2022 forecast of semiconductor capital

expenditure (CapEx) by headquarters

l o c a t io n . T h e l a c k of fo c u s o n

Figure 1: Global semiconductor manufacturing by location in percent. SOURCES: Boston Consulting Group,

Semiconductor Industry Association, SEMI semiconductors on the part of the U.S.,

EU, and particularly Japan, is very

problem statement as: “U.S. leadership in their own equivalent “CHIPS Act” to try telling in these trend lines. While the

semiconductor is threatened by the lack to achieve their own strategic autonomy percent of the U.S. semiconductor-

of U.S.-based capacity for prototyping, and resilience. The EU launched an related CapEx has dropped from 31%

scaling and transfer-to-manufacturing ambitious project in 2013 to double to 27%, and Europe’s has dropped

of b r e a k t h r ou g h s e m ic ond u c t or its onshore share of semiconductor from 8% to 3% from 1990 through

technologies that are the foundation of production. However, almost ten years today, Japan’s share of semi CapEx has

future information and communications on, its share has remained around 10%. dropped significantly, from 51% to less

solutions necessar y for national This time around, seemingly more than 4%, during the same period. Just

security and economic resiliency.” The serious, the EU has launched its own like the U.S. and the EU, the Japanese

CHIPS Act is geared towards a “course “CHIPS Act” in February of this year government is also adopting policies

correction” to grow the capability from that is geared to generate €43 billion to ensure “strategic autonomy and

lab-to-fab domestically. in public and private funding. Similar indispensability.” In November of 2021,

The second argument about such to the U.S. bill, the EU Act has three it approved a ¥774 billion package

industry subsidies being a protectionist distinct pillars. The first pillar is to to boost domestic semiconductor

move is not unfounded either. Indeed, increase research, development and production that included a ¥400 billion

despite all the progress in globalization pilot production lines on European soil. subsidy to TSMC for a new foundry in

made during the last decades, the This partnership not only includes the the southern island of Kyushu.

recent trend seems to be more toward

protectionism with an increasingly

polarized view of the world—a world that

has become increasingly complex by the

realities of today’s heightened geopolitical

tensions. But the goal here is not

necessarily to take over semiconductor

manufacturing domination from the likes

of Taiwan or the Asian nanoscale duopoly

of Samsung and TSMC, but rather to

achieve a healthy level of independence of

the semiconductor supply chain to reduce

the risk of dwindling or no supplies, at

least for some of the critical products.

Even if the U.S., EU and Japan tried to

take over semiconductor manufacturing

dominance, it will take years, perhaps

even a decade or so, based on their

capabilities today.

The U.S. is not alone in this quest to

achieve a healthy level of independence.

Both Europe and Japan have launched

Figure 2: Semiconductor capital expenditure by headquarter locations. SOURCE: IC Insights

Chip Scale Review November • December • 2022 [ChipScaleReview.com] 7 7